Ontario’s iGaming Sector in Q2 FY 2024-25: A Category-Wise Analysis

Ontario’s iGaming market has continued its impressive growth into the second quarter of FY 2024-25.

Each gaming category—casino games, sports betting, and peer-to-peer (P2P) poker—has contributed distinctively to the market’s performance, reflecting diverse player interests and revenue dynamics.

Here’s a closer look at each category’s performance and the factors driving growth in the Ontario gambling environment.

Ontario iGaming Market Performance Report - Q2 FY 2024-25

Casino Games: Dominating the Market with 86% of Total Wagers

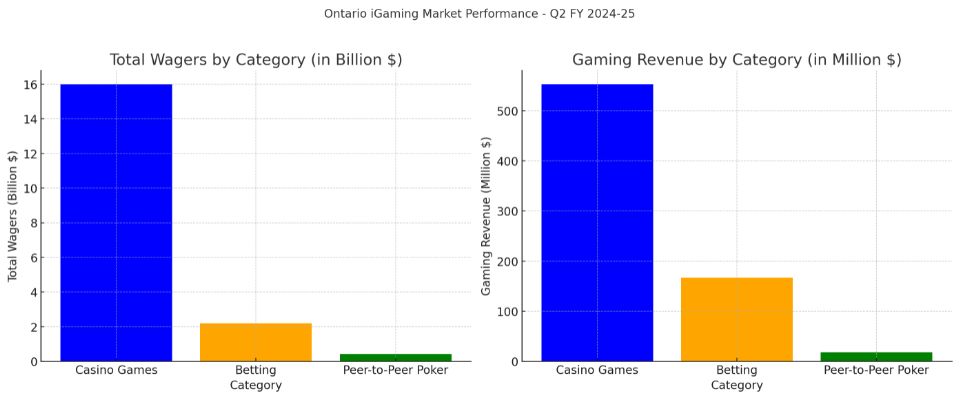

Casino games remain the backbone of Ontario’s iGaming sector, capturing $16 billion in total wagers, which constitutes 86% of the total handle for Q2. This category, which includes online slots, live and virtual table games, and bingo, generated $553 million in gaming revenue, or 75% of the quarter’s total revenue.

Key Drivers:

- Diverse Game Offerings: The wide range of casino game types appeals to various player segments. Slots continue to draw high engagement due to their simplicity and variety, while live dealer options attract players seeking more interactive experiences.

- Sustained Player Engagement: With over 1.32 million active player accounts, average monthly spending per player increased to $308, indicating not only an expanding player base but also deepened engagement among existing users.

Year-Over-Year Growth:

The casino segment grew 36% year-over-year in revenue, suggesting continued popularity and possibly a shift toward online alternatives for traditional gaming preferences. This sustained growth highlights Ontario’s ability to attract players who might otherwise be spending in unregulated environments, keeping revenue within the province’s regulated framework.

Sports Betting: Resilient Despite Seasonal Fluctuations

Sports betting remains the second-largest category, recording a handle of $2.2 billion, which equates to 12% of the total wagers. Despite a slight quarter-over-quarter dip due to seasonal factors, sports betting achieved $167 million in revenue, marking a strong 41.5% increase year-over-year.

Key Drivers:

- Year-Round Engagement: Although sports betting often sees dips in engagement during quieter seasons, the 12% of wagers captured in Q2 reflects a resilient demand for betting on sports, esports, novelty, and proposition bets.

- Growth in eSports and Non-Traditional Sports: As traditional North American sports leagues slow during summer months, there’s an observed increase in bets on esports and novelty wagers, diversifying sports betting revenue streams.

Seasonal Impact:

Summer months typically experience a drop in major North American sports events, affecting betting volumes. Despite these seasonal challenges, the category maintained year-over-year growth, signalling strong market health and expanding interest in Ontario sports betting. Looking ahead, the return of fall and winter sports seasons is expected to boost engagement further.

Peer-to-Peer Poker: A Niche with Steady Growth

Peer-to-peer poker, though a smaller segment of Ontario’s iGaming market, has demonstrated steady performance, contributing $417 million in wagers and $18 million in revenue for Q2. This category accounted for just 2.2% of total wagers and 2.4% of revenue, yet it plays a vital role in the overall market by appealing to a specific demographic of players.

Key Drivers:

- Loyal User Base: Poker tends to attract a dedicated, strategy-oriented player base. Although this segment is smaller, its consistent growth points to a committed user group.

- Increase in Online Poker Tournaments: Ontario’s regulated market has seen an increase in online poker tournaments, which encourages ongoing participation and fosters player retention.

Year-Over-Year Growth:

With a 5% increase in wagers year-over-year, the poker category shows potential for continued steady growth. As live events return and more players seek online alternatives for traditional poker experiences, P2P poker may see incremental growth, though likely at a slower pace than casino games or sports betting.

Market Takeaways and Future Outlook

Ontario’s iGaming market’s categorical breakdown offers valuable insights into player preferences. The strong performance in casino games and sports betting showcases the market’s resilience, even amid seasonal fluctuations. The steady growth in poker demonstrates the importance of catering to niche segments.

Ontario’s regulated market has set a high benchmark, not only in North America but as a case study for other regions considering iGaming regulation. The data reflects a positive balance between a broad player base and high engagement levels, reinforcing Ontario’s role as a leading jurisdiction in iGaming expansion.

As quarterly reports continue, insights into player spending, engagement, and categorical trends will help shape the market’s ongoing evolution and inform regulatory decisions across Canada.

Our Sources

The data and insights presented in this report are based on iGaming Ontario’s FY 2024-25 Q2 Market Performance Report, covering player engagement, wagering trends, and revenue distribution across Ontario’s regulated online gaming market.

Further insights into the market’s growth trends and quarterly performance were sourced from analyses by iGaming Post, offering a detailed view of Ontario’s expanding iGaming landscape and shifting player dynamics.

Read All iGaming Ontario Market Performance Reports

Rowan is a highly accomplished sports betting journalist with a proven track record of over 6 years in the sports media industry. He is widely recognized for his insightful coverage and thought-provoking commentary on major leagues like the NBA, NFL, and NCAA.

Leave a comment