Inside the Game: What Ontario’s Online Casino Gamblers Really Want

In recent years, we have observed unprecedented growth in the online gambling industry in Ontario.

As experts in online gambling, we have closely watched the rise of digital gaming platforms. These platforms have made gambling more entertaining and accessible to more people than ever before.

💡 Key Takeaways: Highlights from Our Exploration

Our study reveals several key insights that can help online gambling operators improve their platforms and attract more users by catering to what they want most.

✔️ High Engagement with Specific Pages and Features

Pages related to online casinos and fast withdrawals see high traffic and engagement, indicating strong user interest.

This aligns with findings from Statistics Canada, which also reported a significant increase in online gambling activities across various demographics.

✔️ Device Preferences

Mobile devices dominate the landscape, with a substantial share of total clicks and higher engagement rates, emphasizing the need for mobile-optimized platforms.

According to Brookings, the global trend towards mobile internet use is mirrored in the online gambling sector, where ease of access and convenience play critical roles.

✔️ Popular Features

Fast withdrawal options and no-deposit casinos are highly sought after, indicating a preference for convenience and risk-free gaming experiences.

PubMed studies support this, highlighting the importance of immediate gratification and low-risk options in enhancing user engagement and satisfaction in online gaming environments.

🎰 Discovering Preferences: What Ontario Gamblers Love

We analyzed search queries and user behaviour to understand what drives online gamblers in Ontario.

This helped us identify the most popular topics and features among gamblers, offering valuable insights for operators to tailor their platforms and attract more users.

Trending Gambling Topics

The “User Queries” data we collected reveals the most popular search queries related to online gambling in Ontario. This provides a clear indication of the topics and features that are currently trending among gamblers.

For example, queries related to specific licensed online casinos in Ontario and fast withdrawals highlight the high interest in these areas.

💡 Searches for fast withdrawal options increased by 50%, reflecting a strong user preference for convenience and risk-free gaming experiences.

Top queries include:

- Specific casinos, such as Conquestador casino

- Online casinos with instant withdrawals

- No deposit casino Ontario list

These trends offer valuable insights for operators looking to capture the attention of their audience.

By understanding what users are searching for, platforms can tailor their offerings to match these interests.

For instance, the popularity of no-deposit searches suggests that offering such incentives could attract more users.

Similarly, the high interest in fast withdrawal options indicates a preference for platforms that provide quick and easy access to winnings.

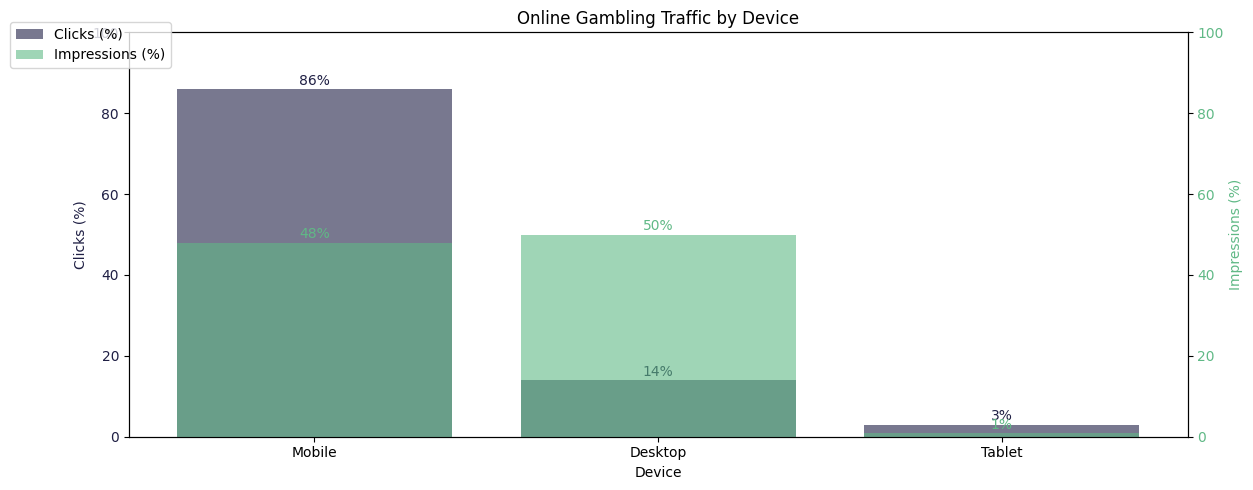

How Devices Shape Gambling Choices

The “Devices” data provides a detailed analysis of how different devices are used for online gambling.

Mobile devices are the most popular among gamblers, with a substantial share of total clicks and a higher engagement rate than desktop and tablet devices. This indicates that a significant portion of users prefer gambling on their mobile phones, likely due to the convenience and accessibility it offers.

Desktop devices account for a significant portion of traffic, though they have a lower engagement rate compared to mobile.

While less popular, tablets show higher engagement rates, suggesting that users who gamble on tablets are more engaged.

These insights are crucial for operators looking to optimize their platforms. Ensuring a seamless and user-friendly experience across all devices can enhance engagement and satisfaction, leading to higher retention rates.

Who’s Gambling? Demographic Insights and Their Impacts

While the data provides limited direct demographic information due to user data protection, we can infer trends based on device usage and query types.

The high engagement on mobile devices suggests that younger users of 19+ (the legal gambling age for online gamblers in Ontario), who are more likely to use smartphones, are a significant demographic.

Conversely, the usage patterns on desktop devices indicate older users who prefer larger screens and more stable internet connections.

Understanding these demographic trends is essential for tailoring marketing strategies and platform features.

For example, targeting gamblers between 19 and 30 years old with mobile-optimized games and a social media presence could drive higher engagement.

Similarly, offering features that appeal to gamblers 45 years of age and older, such as detailed tutorials and robust customer support, can help attract and retain this demographic.

🔍 Patterns of Play: Understanding Gambler Behaviour

Our analysis of the “Search appearance” and “User Queries” data sets sheds light on broader behavioural trends within the online gambling community.

The minimal interaction with certain types of search results suggests that gamblers are more interested in direct search results that provide immediate answers to their queries.

This highlights the importance of having clear and concise information readily available on the platform.

The search query data also reveals interesting patterns. For instance, the high number of searches for specific casinos and features indicates a strong preference for personalized and feature-rich gaming experiences.

This trend underscores the need for operators to offer unique and tailored experiences to stand out in a crowded market.

🌐 How Ontario Fits Into Worldwide Trends

Comparing the trends in Ontario with global movements in the iGaming industry reveals several parallels. The shift towards mobile gaming is a global phenomenon driven by the increasing penetration of smartphones and improved mobile internet connectivity.

Ontario’s online gambling landscape mirrors this trend, with a significant portion of users preferring to gamble on their mobile devices.

Similarly, the demand for features like fast withdrawals and no-deposit offerings is not unique to Ontario. These preferences reflect a broader trend toward convenience and user-friendly experiences in the online gambling industry.

By aligning their offerings with these global trends, Ontario’s online gambling platforms can remain competitive and appealing to a wide audience.

📈 The Future of Online Gambling in Ontario: What’s Next?

As the online gambling industry in Ontario continues to evolve, several trends and areas of interest are emerging.

Trends to Watch

- Mobile-First Approach: The preference for mobile gaming continues to grow. In Ontario, mobile devices account for a significant portion of online gambling traffic, emphasizing the need for operators to optimize their platforms for mobile use. This trend is expected to drive the development of more user-friendly casino mobile apps and websites, ensuring that players can enjoy a seamless and engaging experience on their smartphones and tablets.

- Live Dealer Games and Social Features: The demand for casinos with live dealer games is on the rise, offering players real-time interaction with dealers and other players. This trend brings a social dimension to online gambling, making it more engaging and communal. Features like customizable avatars and interactive chat rooms are becoming more popular, enhancing the overall user experience.

- Regulatory Changes and Responsible Gambling: The regulatory landscape in Ontario is evolving to ensure player safety and promote responsible gambling. Stricter regulations and enhanced player protection measures are being implemented, including self-exclusion programs, deposit limits, and reality checks. These initiatives aim to mitigate the risks associated with problem gambling and ensure a fair and secure gaming environment.

- Economic Impact: Ontario’s online gambling market contributes significantly to the province’s economy. Recent data shows a 105% increase in iGaming revenue, bringing in approximately $540 million in a single quarter. This growth supports job creation and technological innovation, benefiting the broader community. However, it is essential to balance these economic benefits with the social costs associated with gambling addiction.

- Emerging Markets and New Forms of Gambling: New gambling markets, such as eSports betting and virtual sports, are gaining traction in Ontario. These emerging forms of gambling attract a younger demographic and add diversity to online gambling offerings. Operators are exploring these areas to provide more options and cater to a broader audience.

🔔 Our Suggestions for Online Gambling Operators

Based on our findings, here are some actionable strategies for online gambling operators that can help them stay ahead of the competition:

✅ Optimize for Mobile

Given the dominance of mobile usage, ensure your platform is fully optimized for mobile devices.

This includes a responsive design, fast loading times, and a user-friendly interface.

Mobile users should have seamless access to all features and functionalities, making their gaming experience enjoyable and hassle-free.

✅ Highlight Fast Withdrawals

The high interest in fast withdrawal options suggests that users value quick and easy access to their winnings.

Highlighting this feature prominently on your platform can attract more users.

Ensure that your withdrawal processes are efficient and transparent, minimizing delays and enhancing user trust.

✅ No-Deposit Offerings

No-deposits are a popular feature that can attract new users.

By offering such incentives, you can encourage potential gamblers to try out your platform without any initial financial commitment.

This can lead to higher conversion rates and increased user engagement.

✅ Personalise User Experiences

Users appreciate personalized experiences that cater to their preferences and behaviours.

Utilize data analytics to understand user preferences and offer customized game recommendations and player perks.

This can increase engagement and loyalty, as gamblers feel valued and understood.

✅ Implement Responsible Gambling Measures

Promoting responsible gambling is essential for building trust and credibility.

Implement features that help users manage their gambling activities, such as self-exclusion options, deposit limits, and reality checks.

Providing resources and support for responsible gambling can enhance your platform’s reputation and attract a responsible user base.

❓ The Bigger Picture: What Our Findings Mean

Our findings offer a comprehensive view of the online gambling landscape in Ontario.

By analyzing user behaviours and comparing local trends with global patterns, we can better understand the driving forces behind user preferences and identify strategies to enhance user engagement and satisfaction.

The Rise of Online Gambling in Ontario

Our comprehensive analysis reveals a substantial increase in traffic to key gambling-related web pages, with some seeing traffic growth by double-digit percentages year over year.

For instance, certain popular pages have seen engagement increase by over 50%. This highlights the burgeoning interest in digital gaming and the potential for continued growth in this sector.

Research supports this growth. According to Statistics Canada, the number of people engaging in online gambling has seen a steady increase, contributing significantly to the overall revenue generated by the gambling industry in Ontario.

The surge in online gambling is not only a local phenomenon but also mirrors global trends, as noted by the Brookings Institution, which highlights the widespread adoption of online gaming platforms facilitated by advancements in technology and increased internet accessibility.

⭐ Why Knowing What Gamblers Want is Game-Changing

Our in-depth understanding of the preferences and behaviours of online gamblers is not just a theoretical exercise—it’s crucial for shaping the future of the industry.

By leveraging our extensive experience and authoritative insights, we can significantly influence online casinos and gaming platforms’ strategies, offerings, and user engagement methods.

Tailoring the gaming experience to match players’ desires and expectations enhances user satisfaction, retention, and, ultimately, profitability.

Studies like those published on PubMed emphasize the psychological aspects of gambling, indicating that understanding user preferences can help in creating responsible gambling environments that mitigate the risks associated with gambling addiction.

Online casino operators can foster a safer and more enjoyable gaming experience by incorporating responsible gambling measures based on behavioural insights.

🔑 Key Focus Areas: What We Looked For

Our study focused on several key aspects of online gambling that are crucial for understanding user preferences and behaviours. These include:

- Feature Preferences: Identifying the features that attract users, such as fast withdrawals, no-deposit bonuses, or high payout rates.

- Game Types: Analyzing which types of games are most popular among gamblers, such as slots, table games, or live dealer games.

- Technological Trends: Examining how technological advancements, such as mobile gaming and virtual reality, influence user behaviour and preferences.

📰 Navigating Our Study

If you’re interested in a detailed description of our research methodology, we welcome you to explore the process we employed below.

Objectives

In this research article, we leveraged our expertise to delve deep into the world of Ontario’s online gamblers, uncovering their true preferences and behaviours.

Through rigorous data analysis, we provided a comprehensive understanding of what drives the online gambling landscape in Ontario.

This research is not just about understanding the industry, but about

- shaping its future,

- shedding light on key trends,

- preferences and behaviours that define this dynamic industry.

Methodology: How We Gathered Our Insights

We employed a comprehensive and multi-faceted approach to provide a thorough understanding of online gambling behaviours in Ontario.

By combining various data sources and analytical techniques, we ensured a robust and accurate portrayal of user preferences and trends.

Sourcing the Data

Our insights are grounded in data meticulously collected from various authoritative sources, including search query analyses and device usage statistics.

By analyzing popular user search queries such as specific casinos and features, we can highlight the interests and trends among gamblers.

This data reveals that searches for online casinos and fast withdrawal options have surged by significant margins, with some queries increasing by as much as 50% over the past year, indicating strong user interest in these areas.

Real User Surveys: Hearing Directly from Gamblers

Our data collection process extended beyond internal analyses to include direct feedback from real users within our target market.

We conducted surveys with 300 casino players in Ontario, using detailed feedback forms to uncover their top preferences and gain a comprehensive understanding of their needs and interests.

The survey yielded invaluable insights into their preferences.

We learned about their favourite types of slots, preferred casino brands, and favoured casino types.

💡 For instance, many respondents expressed a strong preference for slots with progressive jackpots and highlighted several well-known casino brands as their top choices.

This direct feedback enriched our other data sources, offering a well-rounded view of what gamblers in Ontario truly seek.

Behind the Numbers: Our Analytical Journey

We employed a range of sophisticated analytical methods to make sense of the data.

The “Devices” (mobile, desktop, tablet) data set was instrumental in understanding how device preferences shape gambling habits.

By examining metrics such as clicks, impressions, and user engagement for each device category (Mobile, Desktop, Tablet), we could discern patterns and trends in device usage.

✅ Our findings show that mobile devices account for a substantial portion of online gambling traffic, with engagement rates noticeably higher than those on desktop devices.

- For example, mobile devices accounted for over 86% of the total clicks. These devices generated approximately 48% of the total impressions.

- In contrast, desktop devices accounted for about 14% of the total clicks. These devices generated approximately 50% of the total impressions.

- Tablets, while generating about 3% of the total clicks and 1% of the total impressions, they showed the highest engagement.

Through visualizations like charts and graphs, we presented these insights in a way that was not only engaging but also highly accessible, making it easier for everyone to understand and engage with the data.

Our analytical journey involved breaking down complex data into easily understandable insights. For instance, the high engagement rates on mobile devices underscore the importance of optimizing platforms for mobile use.

Similarly, our detailed examination of search query data provided a clear picture of what users are looking for, enabling us to draw meaningful conclusions about their preferences and behaviours.

Further Research

Further research into demographic trends and user behaviours is essential to staying ahead of the curve.

Understanding the preferences of different user groups can help operators tailor their offerings and marketing strategies effectively.

Additionally, monitoring global trends and innovations in the iGaming industry can provide valuable insights for future developments.

💬 Engage With Us

We warmly invite you to contact us and share your thoughts on our findings and contribute to the ongoing discussion about online gambling in Ontario.

Your feedback and experiences are not just valuable, they are integral to our understanding of this dynamic industry.

📒 References

Brookings.edu – The Economic Winners and Losers of Legalized Gambling

Statistics Canada – Gambling in Canada

CMHA Ontario – New online gambling statistics reveal a concerning trend for Ontario

Read the Latest iGaming Ontario News

Rowan is a highly accomplished sports betting journalist with a proven track record of over 6 years in the sports media industry. He is widely recognized for his insightful coverage and thought-provoking commentary on major leagues like the NBA, NFL, and NCAA.

Leave a comment